About the Project

Project Name: WealthMaster

Client: Jonathan Cosgrove

My role: I was part of a UX design team (Louis Butterfield, Emily Moore, Honor Pattisson & Jordan Widlund-stone) that shared responsibility for the design, research, and delivery of the final project.

Overview: Financial matters can be personal and emotive, rewarding and stressful. Everyone approaches them differently. However, the fundamental fact remains that people care about their financial well-being. WealthMaster is a responsive wealth management platform that allows the user's to aggregate multiple financial and non-financial assets in one place to get a consolidated view of their entire portfolio with real-time updates.

Tools used: Stakeholder interviews, surveys, user interviews, competitor analysis, market positioning, affinity mapping, personas, archetypes, task analysis, jobs-to-be-done, problem statement, Figma, wireframing, prototyping, user testing.

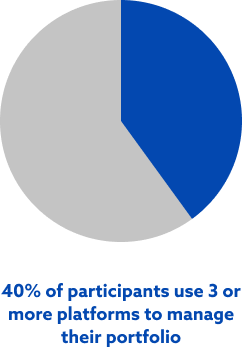

It can be challenging for someone to get a clear picture of their financial well-being at the best of times, especially if they invest in multiple assets across different platforms. The current solution involves manually inputting data from various sources into an excel spreadsheet, which is time-consuming and prone to error. Our client wanted an easier way for people to view their entire portfolio by creating a platform that consolidates all of their assets in one place, with real-time updates.

Project Kick off - Getting to know the client

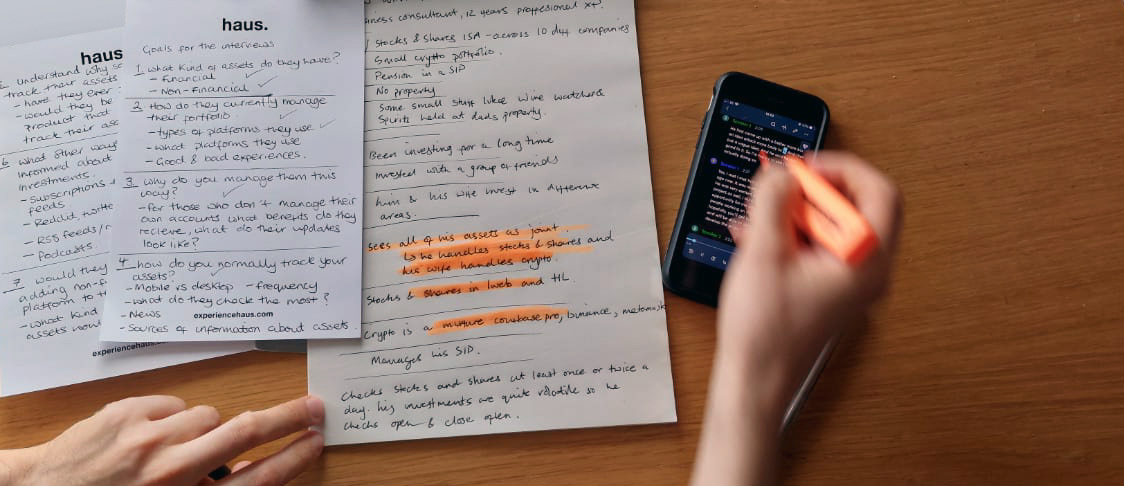

After receiving the brief from Jonathan, we set up a meeting with him to delve deeper into his personal story and understand how he identified the problem space.

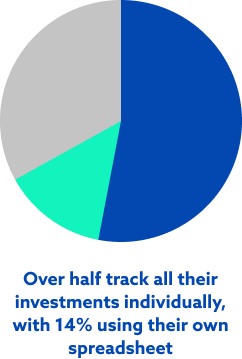

As an active investor, Jonathon likes to keep track of his assets & investments' value and performance. To do this, he puts time aside every week to log into various sources and platforms, so he can collect and manually input all the relevant data into an Excel spreadsheet he created himself.

After sharing his experiences about the tedious process with friends in the hope of finding an alternative solution, he quickly realised he wasn't the only person who did it this way. In response to this, he believed people needed a new simple way of viewing a consolidated portfolio of all their investments that didn't require them to do it manually.

Now that we had developed a basic understanding of the problem space and the specific pain points Jonathan faced, we had to conduct our own research and reevaluate the problem, stripping it back to its core. Our research was divided into two phases, User and Market research.

Getting a sense of who WealthMaster's potential clients might be required us to understand how people view their assets, as well as their habits, feelings and needs related to tracking and getting an overview of their finances and investments. Our first step was to send out a screener survey, which later could be used to source candidates for interviews. From this, we got 25 responses. Initially, we were left feeling a bit disappointed about the number of responses we received for our screener survey but it quickly became clear that people simply didn't feel comfortable or able to give away sensitive information on an online form.

After the survey, we again reached out to our personal networks to recruit more participants. Fortunately, people felt more comfortable speaking with us over the phone, through Zoom, or in person. This allowed us to interview

51 participants representing a variety of demographics, professions, and perspectives on risk. For the interviews, we developed a discussion guide based on several key research objectives to determine how people track and manage their assets currently, why they do so, and how they feel about changing how they do this in the future.

51 participants representing a variety of demographics, professions, and perspectives on risk. For the interviews, we developed a discussion guide based on several key research objectives to determine how people track and manage their assets currently, why they do so, and how they feel about changing how they do this in the future.

From our interviews, we collected more than 650 data points, consisting of observations, behaviours, emotions, and key quotes. In order to make sense of all this information, we started affinity mapping to identify key themes and trends that would guide our approach to the challenge.

1. There are two clear types of investors

A long-term view on investments vs. a short-term riskier approach

Although there are several types of investors, there are two main groups. The first is the Long-term investor who seeks financial stability, protection, and 'future-proofing' themselves and their families. While some people prefer to take greater risks with their finances in order to maximize their returns in the short-term

2: Knowing your money is working for you and seeing growth.

Even though different investment strategies and approaches exist, all share a common goal: to see growth and know their money is working for them.

“Ultimately your finances should be working for you so that you don’t have to invest loads of time and you can concentrate on other life issues”

3. Being aware of information other than an asset's value is an essential part of getting an overview.

People like to keep informed about their investments through multiple social media platforms, online publications, and subscription services.

"Finimise is something I'm subscribed to and regularly check. It’s an application that you subscribe to for very up to date news and well-written articles by analysts."

4. Interest in ethical investing is high.

More and more people are taking notice of where their financial investments are being made and how they can ensure they're going into sustainable funds and sectors.

“People aren’t aware of what’s being done with the money in their pension, and I think a lot of people would be shocked if they found out.”

5: Different views on assets.

Some people view their property as a part of their net worth, while others do not because it's something they'll never sell, or because there are liabilities associated with it.

“I’m probably never going to liquidate those assets so I really don’t see it as part of my net worth”

“My house is part of my short term plan to build my net worth and make some quick money”

6. Flexible tools that can provide different overviews

Tools need to be flexible with the ability to provide different types of overviews because not all assets behave the same way, and some have liabilities associated with them.

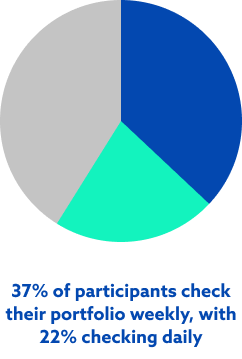

7. Getting an overview is important but people often give up.

The process of managing financial assets manually is time-consuming and prone to error, meaning people often give up.

"I manually put it on a spreadsheet to see how it's evolving, which is hard work. And to be honest, sometimes I just don't feel like doing it. So I'm probably losing out on a couple of opportunities to change the composition of certain assets."

"Very manual, username, password, dual-identification, take down the numbers usually on a post-it note, carry them across and put them on a spreadsheet. Proper old school"

8. The idea of a tool that allowed participants to track all their assets in one place, on the whole, received a positive response.

“I've actually looked specifically for an app that aggregates all of these things because for me that would be so useful”

As we examined the key trends in people's behaviours and current processes, we were able to identify their

analytical and emotional needs when approaching the management of their assets. These were...

analytical and emotional needs when approaching the management of their assets. These were...

The user needs are deeply connected to one another. With more knowledge, people felt in control and able to adopt a flexible approach to how they managed their finances. These 3 core user-centric needs would go on to help define our approach.

Having gained a deeper understanding of our potential users, the next step was to identify and evaluate the competitors of WealthMaster that provided tracking and management of assets. It quickly became clear that there is already a great deal of competition in this space.

We conducted thorough evaluations on a variety of Wealthmasters' competitors, aiming to determine the types of services they provided, the pricing strategies they followed, and the features and unique selling points they offered. Below shows a few examples of the leading direct competitors we found.

Pros

- Free tooling

- Ability to Integrate multiple asset types

- Detailed portfolio analysis showing sector breakdown

- "You index" & fee analysis are powerful tools

- Ability to Integrate multiple asset types

- Detailed portfolio analysis showing sector breakdown

- "You index" & fee analysis are powerful tools

Cons

- Constantly receive calls from personal capital about paid-for services

- Personal capitals paid for services are expensive with high fees and provide poor returns on investment.

- Cluttered overwhelming interface that is hard to personalise

- Personal capitals paid for services are expensive with high fees and provide poor returns on investment.

- Cluttered overwhelming interface that is hard to personalise

Other Comments

- Rigid Corporate style UI

Pros

- Assigned your own personal investment consultant who provides expert advice

- Option to build a more socially responsible portfolio

- Option to build a more socially responsible portfolio

Cons

- Limited number of portfolio options

- High management fees

- Not a suitable option for more experienced investors

- lack of asset integration

- High management fees

- Not a suitable option for more experienced investors

- lack of asset integration

Other Comments

- Modern interface feels accessible

Pros

- Customisable asset groups

- Real-time charts

- Accurately Calculate IRR

- Ability to Integrate multiple asset types

- Real-time charts

- Accurately Calculate IRR

- Ability to Integrate multiple asset types

Cons

- Expensive annual fee subscription $150/year

- No projection tools

- No portfolio analysis showing sector breakdown

- No free tooling unlike competitors

- No projection tools

- No portfolio analysis showing sector breakdown

- No free tooling unlike competitors

Other Comments

- Kubera offers a 14 day trial for $1 to encourage adoption of their

platform.

- Very simple pared-back UI

platform.

- Very simple pared-back UI

With a better understanding of the landscape, it was essential to identify a space that Wealth Master could call its own. We began plotting competitors on the graph (shown below). Pension Bee and Moneyfarm looked modern, fresh, and accessible but lacked the capabilities to track and integrate multiple asset types like the more traditional and well-established wealth management platforms like Personal Capital, Charles Stanley, and St James's place. Here we found a gap in the market for a product that would allow users to integrate and aggregate multiple asset types whilst retaining a modern, fresh and accessible look.

Following the discovery phase, the research was re-analysed and synthesised to form six archetypes. For each, we defined their current financial circumstance, how they managed and/or tracked their finances, and what their long-term goals were. Using this process, we identified our primary user based on their needs and strongest business value. This was the analyst.

"The Analyst"

Sam

Financial Director

£125,000 per annum

Financial Director

£125,000 per annum

Key Information & Behaviours

Owns multiple financial and non-financial assets across a variety of different platforms

Manually tracks assets through an excel spreadsheet created by himself

Uses data to track his entire portfolio, produce IRR and plan for the future

Inputs data weekly.

“Every week I find an hour to log into all the accounts and tally things up to see where we’re at, but it’s entirely manual, there’s no automatic entry.”

In order to understand Sam's current process in greater detail, we created a task analysis of his weekly data collection and input into his personal spreadsheet. This process was long, and repetitive requiring over 100 steps. Having completed the task analysis, we decided to also create an experience map because it was important to understand Sam's feelings during the process too.

After completing the experience map following the task analysis, we found that Sam's experience declined multiple times. It was time-consuming and error-prone. Clearly, we needed to remove a lot of steps from the process when providing Sam with a complete overview of all his assets so he could see that his money was working for him.

Defining the key "jobs to be done" and problem statement for the platform was a crucial step before we entered the design phase. The 3 core pillars we developed as part of our user research provided a foundation from which we built our problem statement.

We began developing the solution for desktop and mobile. We focused on the user flow, signing up process, adding assets, selecting specific asset groups, and responsive infographics that would provide different types of overviews to our users. Once we had refined the user flow and the platform features, we started to digitise our designs in Figma.

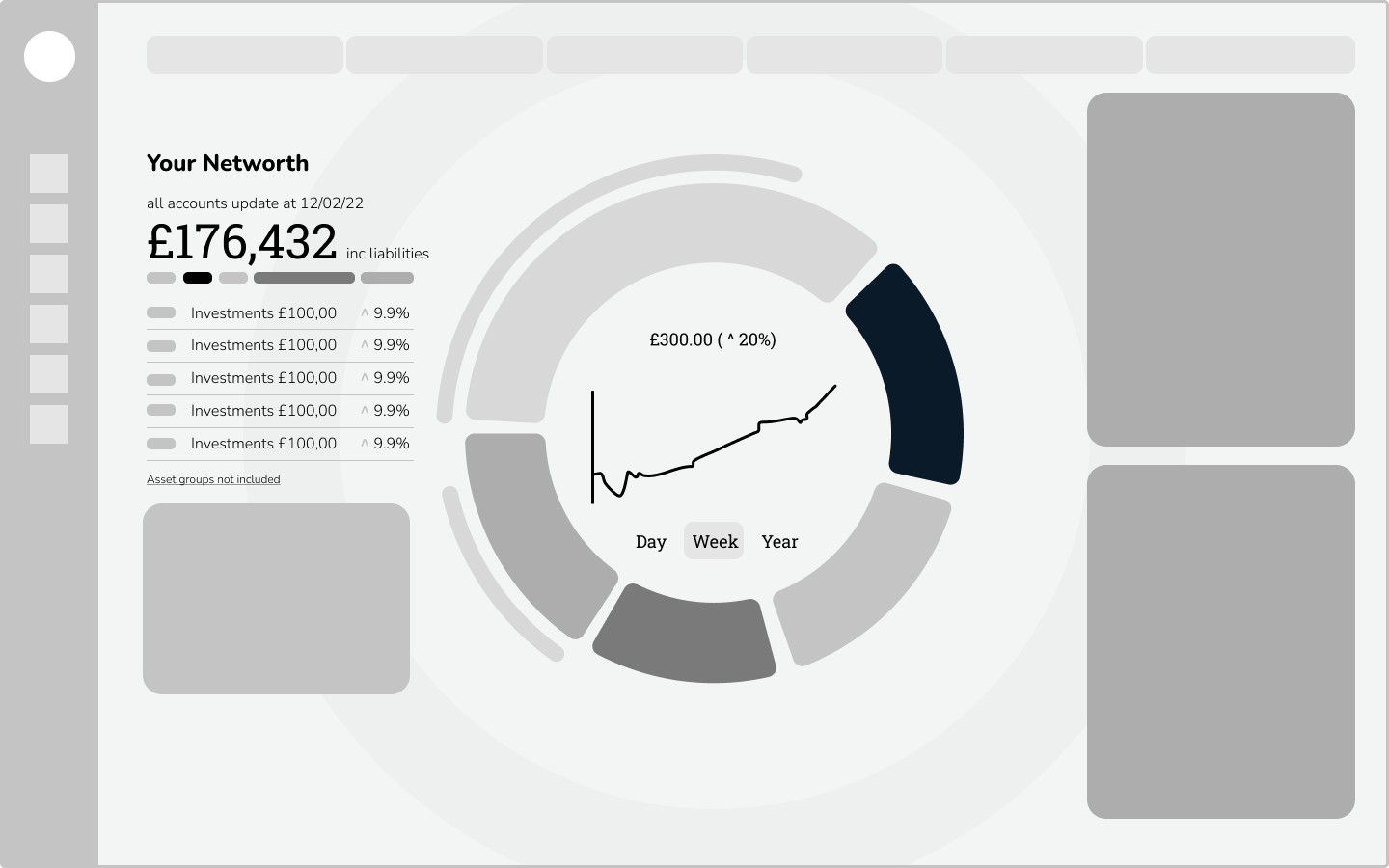

Low-fidelity prototypes were created for desktops and mobile devices. However, due to time constraints, we decided to focus primarily on the desktop version of the platform during this phase to deliver a polished final prototype, with the intention of returning to the mobile version in the future.

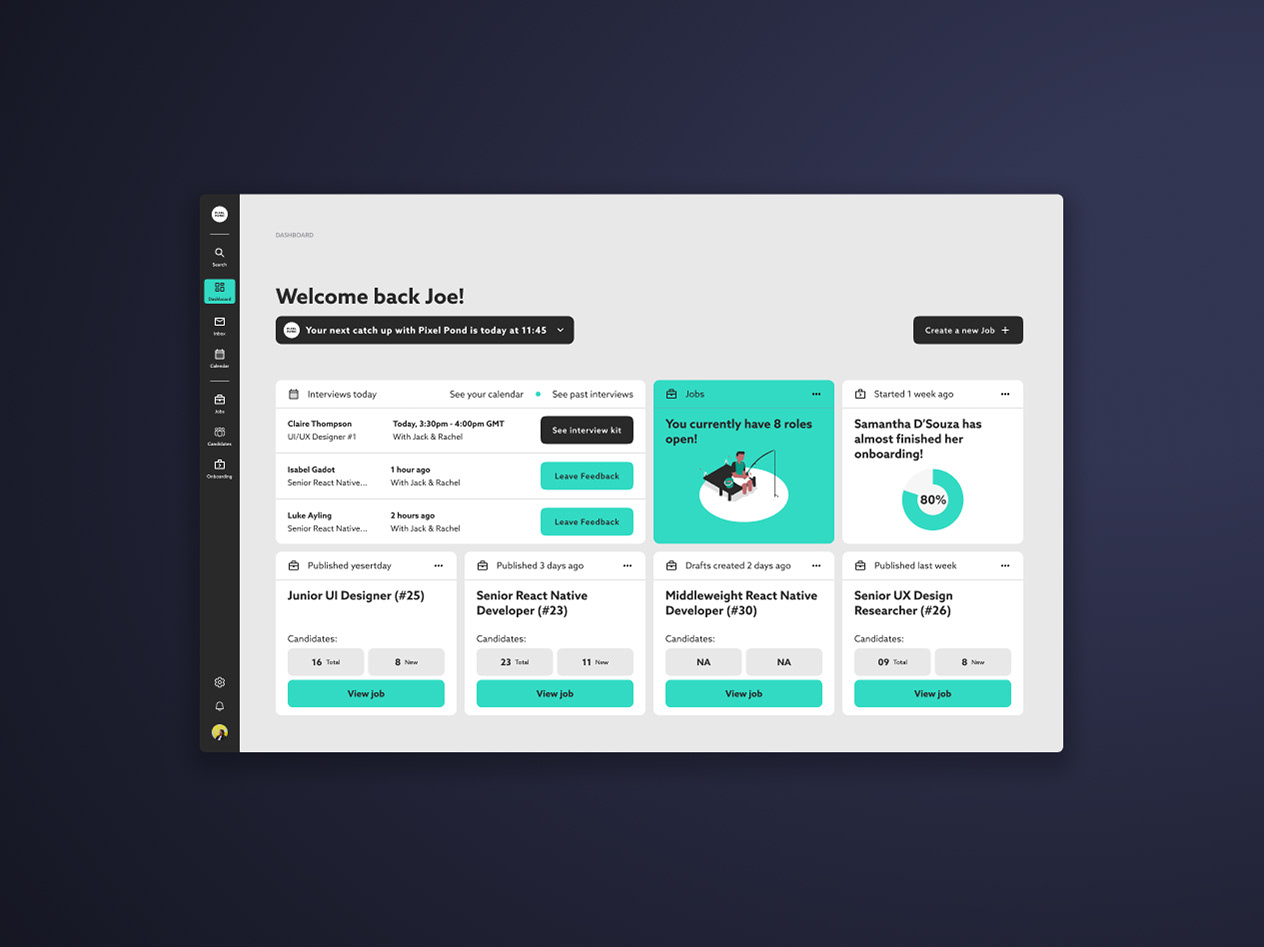

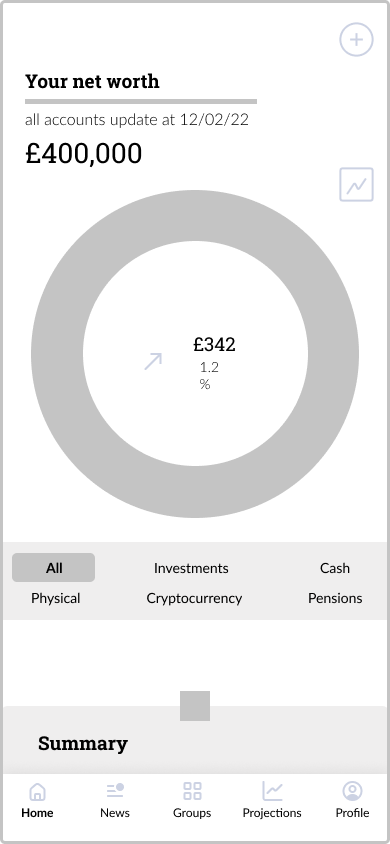

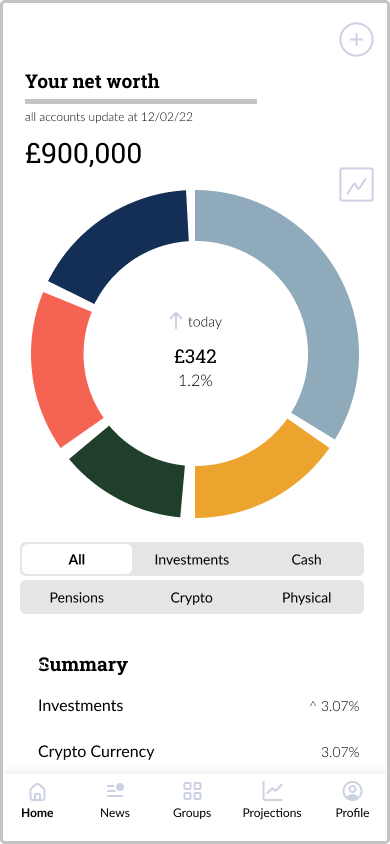

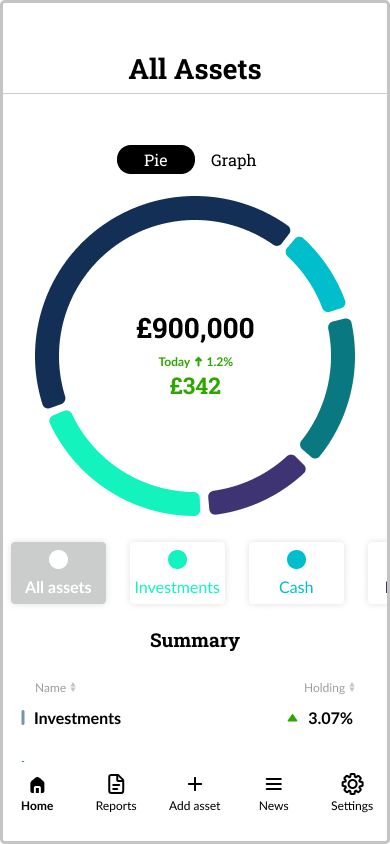

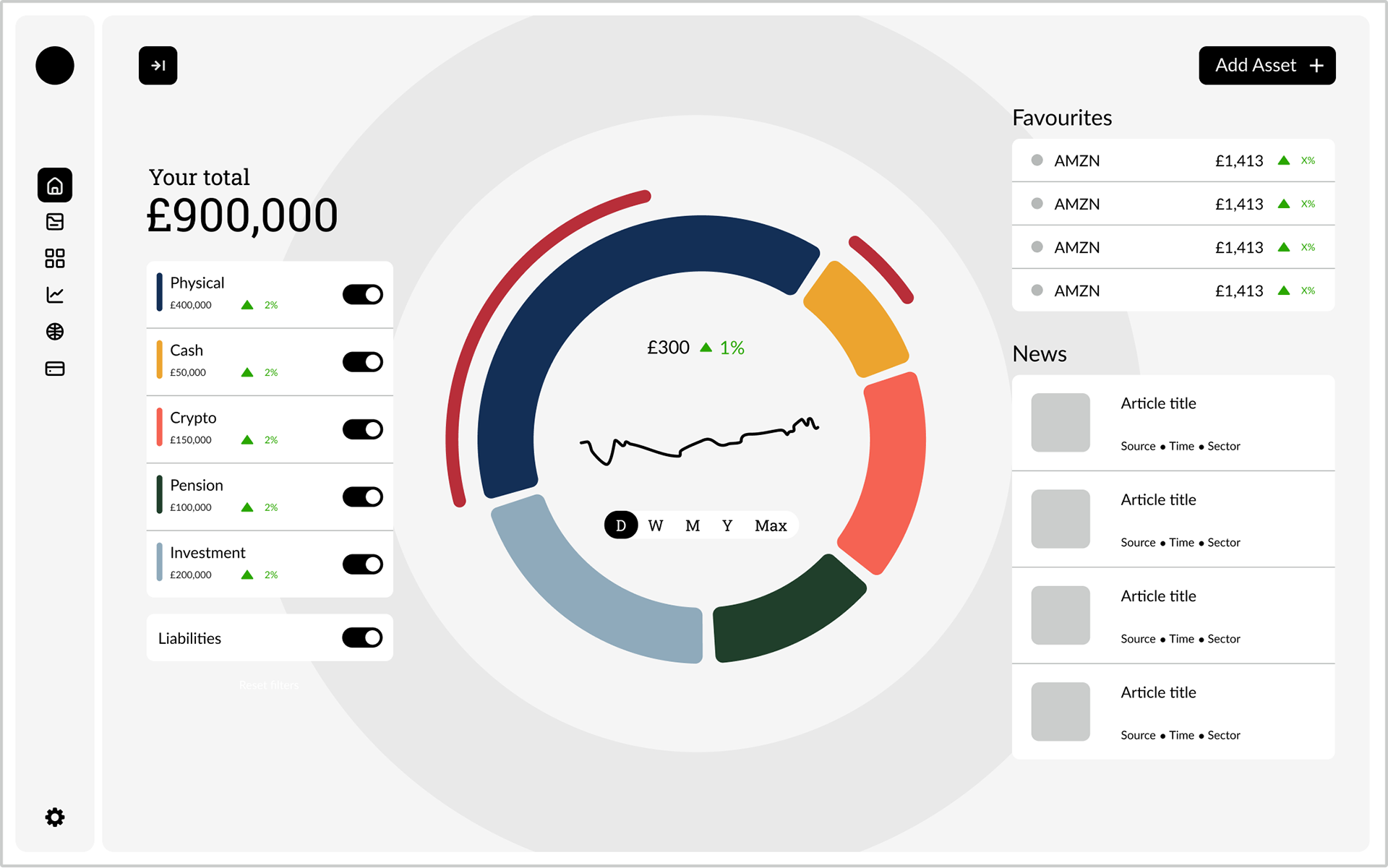

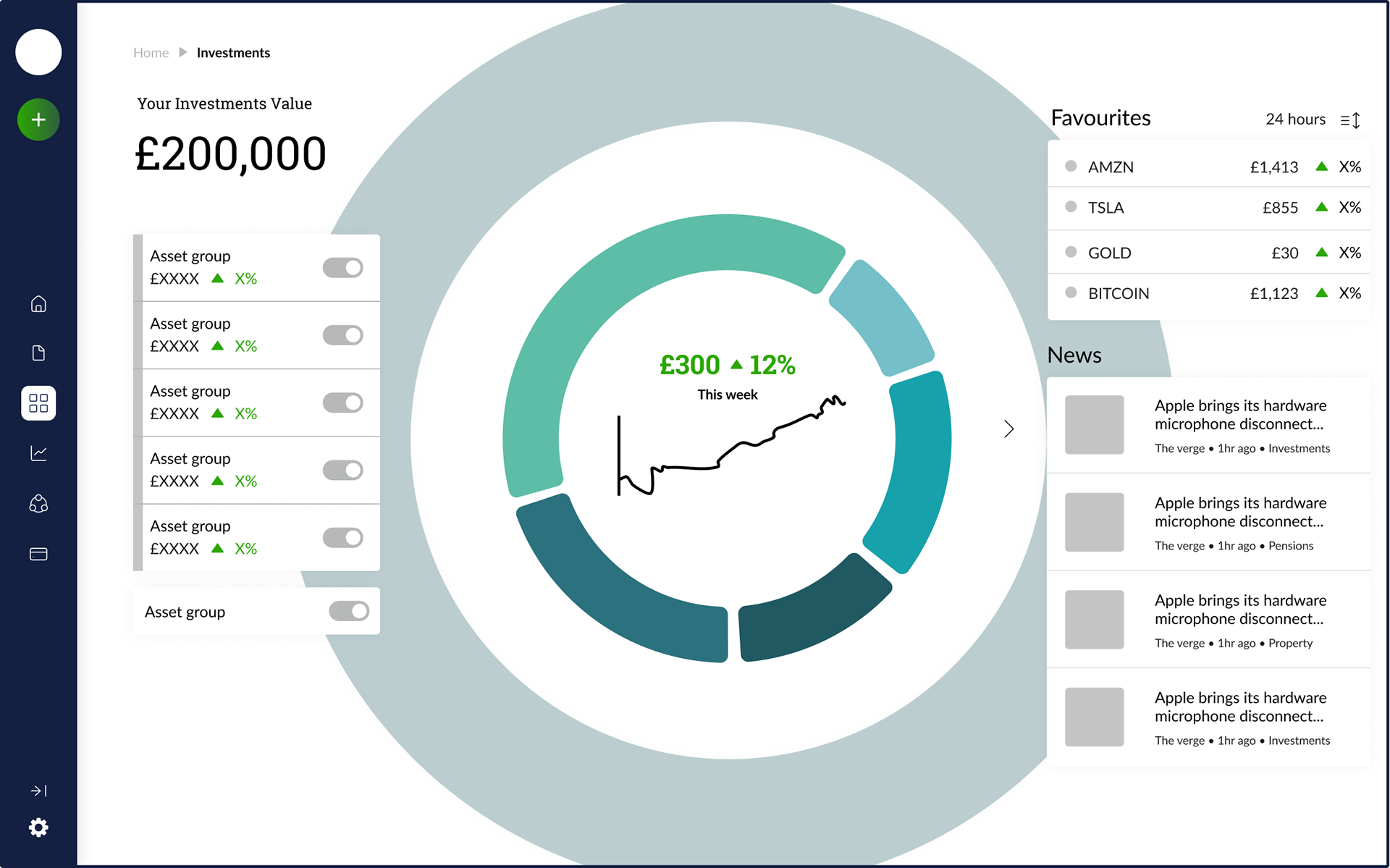

Above, you can see the development of Wealth Master's Dashboard (home page). The main feature is the responsive Pie Chart with a graph in its centre showing a breakdown of the user's portfolio by asset group. As we developed the main dashboard, it was essential that we retained this element whilst exploring different UI layouts that appeared cleaner and more balanced visually. During the entire design process, from low fidelity wireframes to our final prototype, we performed several rounds of user testing, making updates and adding new features as we went along. Here we made changes to the navigation bar, onboarding process, as well as functionalities such as viewing liabilities in the context of specific assets.

As soon as we had incorporated the feedback from multiple rounds of user testing, we were ready to present the final high-fidelity prototype to the stakeholders.

Getting started

It was important to make getting started with WealthMaster as easy and straightforward as possible. Once a user has registered, they can connect their accounts associated with popular providers or manually add assets. Assets are initially automatically assigned to a group which the user can change.

The Dashboard

WealthMaster allows users to easily get a clear overview of their entire portfolio in one place. The responsive pie chart shows the different asset groups within it that can be easily toggled on and off to provide the user with different overviews. Liabilities can also be connected to particular assets and their groups in order to provide a more realistic net worth.

Asset groups and investments

Users can select individual asset groups to get a more detailed look at their performance, connected accounts, market allocations and holdings. Users can also select and view individual holdings in order to view investment history, IRR, and specific news pertaining to them. Lastly, users can also "favourite" individual holdings or assets so they will appear on the main dashboard.

The solution we designed was built around these three core user-centric principles, developed during the research phase of our project. Below illustrates how WealthMaster facilitates each of them

Due to time constraints, we weren't able to accomplish everything we would've liked. For this reason, we created a product roadmap outlining how Jonathan should continue to develop Wealthmaster in the coming months. In its current state, based on our market and user research, all the tooling we have created (a mobile app included within this) would be free. Developing personalised performance reports, growth forecasts and portfolio guidance will allow WealthMaster to carefully place itself between personal capital and Kubera, allowing it to charge its users. With legislation potentially evolving in the future, we also included automated trading and open banking integration as opportunities to capitalise on.

Working with the team and Jonathan on Wealthmaster was incredibly rewarding and challenging.

Done is better than perfect, but if there were more time I would:

Think more about other users?

Our initial assumption was that the main archetype, "The analyst" or "Sam," would provide the most business value as he currently tracks his assets in an excel document on his desktop. A lot of other users also expressed an interest in getting an overview, but simply did not have the time or technical skills to create and maintain an excel spreadsheet, despite regularly monitoring market trends. Offering them an app that allows them to consolidate their portfolio in one place and provide them with a comprehensive overview, projections and analytics would be an incredibly powerful tool they would be prepared to pay for.

Re-think the sign-up process - delayed sign-up flow.

The platform's value should be better communicated to users before they sign up, including the types of assets they can integrate and how the assets are displayed once successfully integrated.

Rebrand

Wealthmaster should be rebranded. In my view, the name is too masculine and doesn't attract other users who might not be so confident when it comes to asset management.

Thanks for making it this far! If you have any questions get in touch with me at hello@joezammit.com